Indonesia’s SKK Migas may dissolve if the new Oil and Gas Law No. 22 of 2001 is passed.

DPR Commission VII member Mulyanto stated the DPR and government are debating a substantial revision. This update creates the Special Business Entity (BUK) to manage the nation’s oil and gas mining.

This new BUK replaces interim SKK Migas. SKK Migas was established in 2012 when the Constitutional Court abolished BP Migas.

The planned BUK has renewed hopes of boosting domestic production, which has been falling.

Indonesia’s Oil and Gas Issues

SKK Migas’ first-half 2023 results aren’t good for Indonesia’s oil and gas industry. The country’s “lifting,” or crude oil production, has dropped to 615.5 thousand barrels per day. This output just meets the 2023 state budget (APBN 2023) goal of 660 thousand bpd.

Weak gas distribution delivered 5,308 MMSCFD in the first half of 2023, 86% of the APBN 2023 objective of 6,160.

Malaysia’s Oil and Gas Industry Succeeds

Indonesia and Malaysia have different oil and gas industries despite being neighbors. Malaysia is Southeast Asia’s second-largest oil producer and fifth-largest LNG exporter.

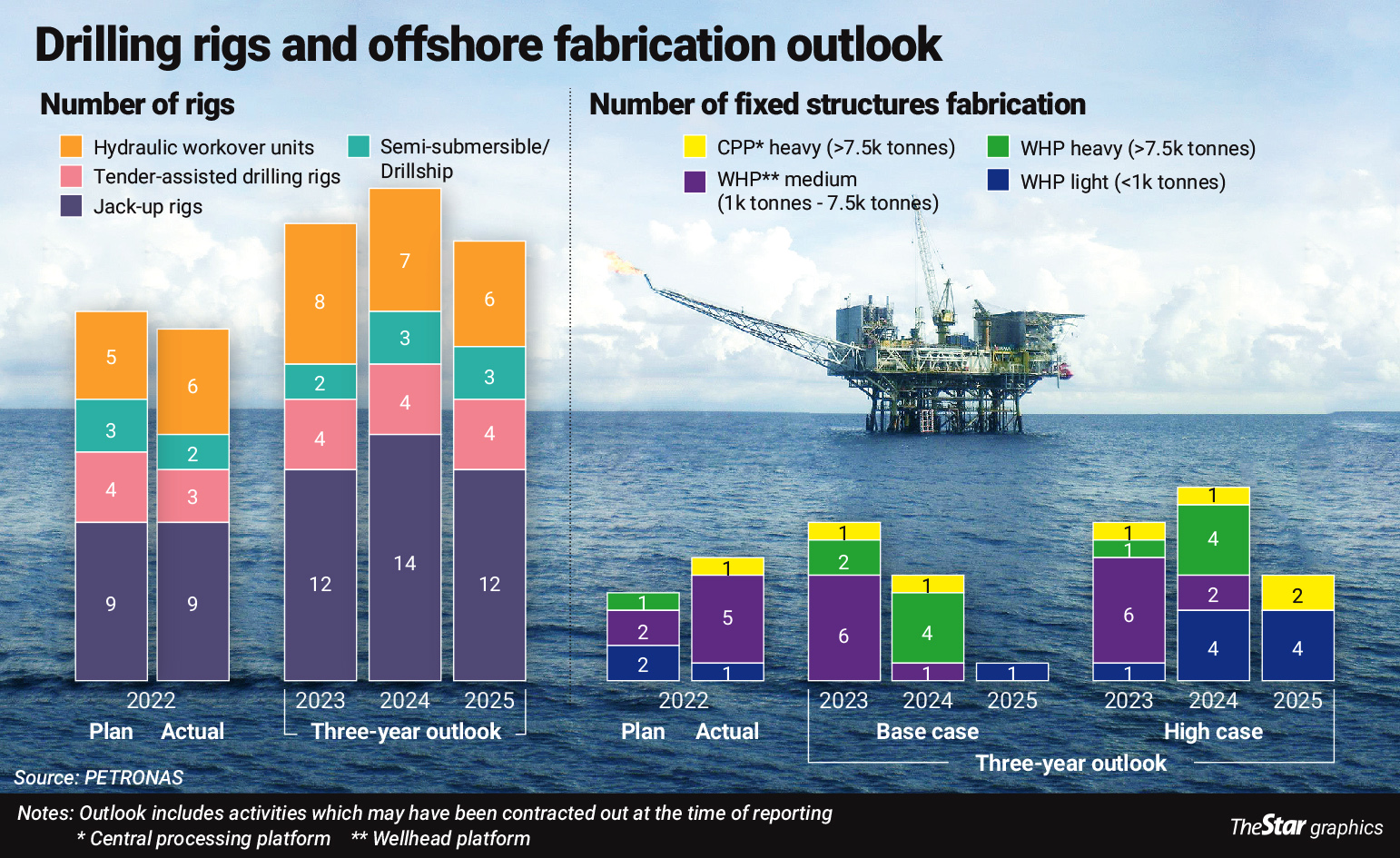

Malaysia has 17 prospective exploration and production projects. Present and future endeavors should climax this year. Cleaner, renewable energy-based futures anticipate fewer projects.

Malaysia has produced 9 billion barrels of oil and 50 trillion cubic feet of gas since 1974. The country generates 660,000 barrels of liquid gold and 7.0 billion cubic feet of gas daily. More promising are the nation’s commercial reserves, estimated at 17 billion barrels of oil equivalent from 400 oil fields, three-quarters of which are gas.

Malaysia’s Oil Guardian Petronas

Petronas protects Malaysia’s energy supply via production. They strategically coordinates with electricity, petrochemicals, and other key sectors.

Their values value-based production and oil/gas monetization. The conglomerate improves its core competencies.

Malaysian investments of MYR 600 billion generated 550,000 barrels of liquid and 6,100 MMSCFD of gas. These investments have supported infrastructure, processing facilities, and proximity to Asia’s increasing demand centres and growth markets since Petronas’ 1974 establishment. Petronas’ 10,000-km pipeline connects 380 offshore locations, 19 floaters, and 14 onshore terminals, showing its commitment. They use helicopter logistics offshore and operate near supply bases.

The Petronas LNG dominance and exploration success

Petronas impact includes LNG. The conglomerate’s Bintulu LNG plant generates 29.3 million tons annually. This facility is one of the world’s largest LNG producers with Petronas Floating LNG one and two. Petronas alone has two floating LNG plants.

Petronas’ Malaysian exploration worked. Over 45 years, Malaysia has drilled 1,200 exploratory wells, delivering seven billion barrels economically feasible oil and gas finds amounting to 75 trillion cubic feet.

Rich Basins and Exploration Blocks in Malaysia

Malaysia has seven producing basins and hydrocarbon deposits, including Peninsular Malaysia, Sabah, and Sarawak. These basins produce, including big discoveries. Malaysia has five trillion cubic feet of gas from world-class finds including Lang Lebah in Central Luconia. And then, these studies show Malaysia’s basins’ untapped potential.

Petronas annually offers exploration sites. Out of 76 exploration blocks, 16 are available for tender and direct negotiations.

Malaysia’s Oil and Gas Forecast

Petronas produces 2.4 million mboepd of gas and oil, whereas Malaysia produces 700,000 bpd. The nation forecasts 2.7 mboepd production by 2030.

Malaysia Teaches

Ironically, Petronas’ success contrasts with Indonesia’s oil and gas sector turmoil. Furthermore, Petronas wanted Indonesia’s management guidance.

Indonesia produced 1.5 million barrels per day in the 1980s and 1990s. Within two decades of independence, Indonesia joined OPEC alongside Saudi Arabia, Qatar, Venezuela, and others. And then, Indonesia influenced global oil market policies. Given its capabilities, Indonesia mentored Petronas in August 1974, providing valuable expertise.

Petronas is learning from Indonesia

Indonesia was a major source of PSC knowledge for Petronas. Obviously, Indonesia pioneered this strategy.

Malaysia smoothly implemented and amended this strategy to meet industry demands, particularly for deep-sea, offshore, and onshore oil exploration.

Bottom Line: Two Oil and Gas Landscapes

Malaysia and Indonesia have diverse histories despite their proximity. Petronas, Malaysia’s exploration, production, and resource manager, excels. As Indonesia suffers with industry challenges and legislative changes, both nations may exchange knowledge to boost Southeast Asia’s ecosystem.

Finally, Petronas, a former student turned teacher, shows how the oil and gas sector requires adaptability and ingenuity.